gst cash payout 2022

The companys payout ratio is a very respectable 81 in terms of earnings and its payout ratio in terms of free cash flows is only around 17. Also discover how your ICICI Bank Coral Credit Card can deliver savings of 18400 every year.

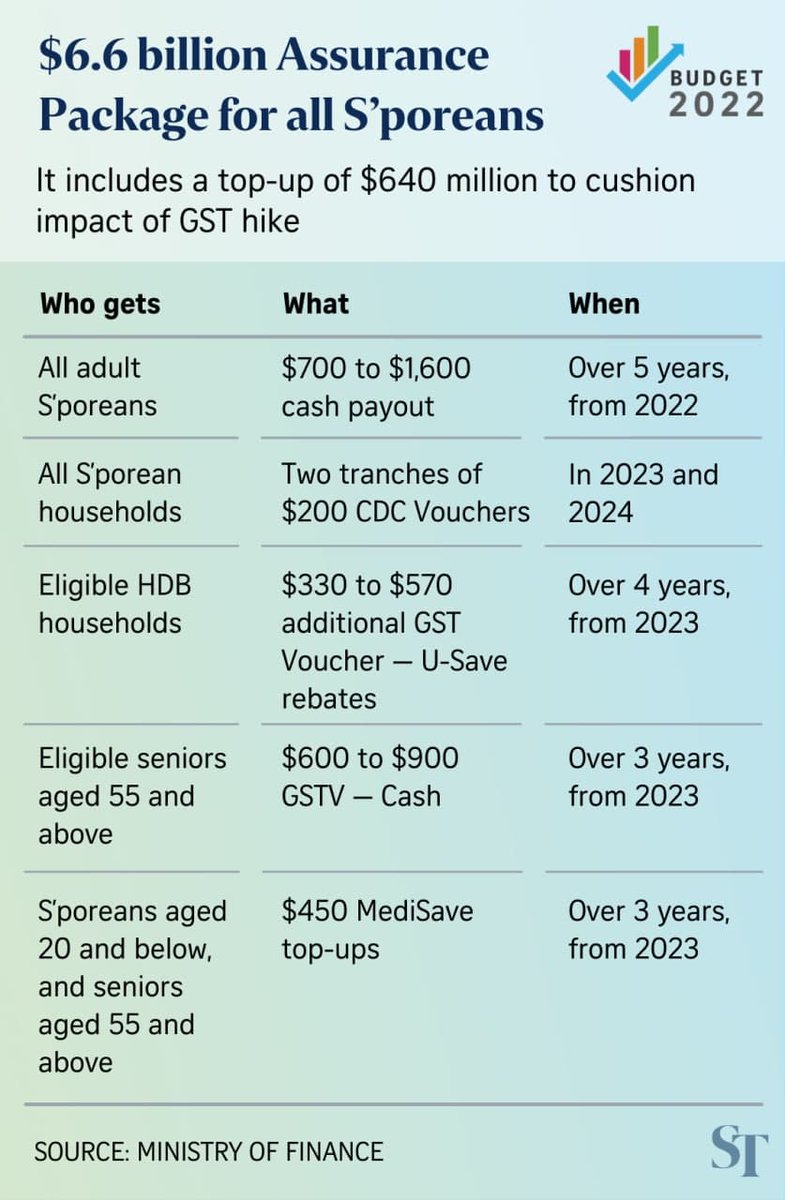

Budget 2022 S Poreans Aged 21 And Above To Get S 700 To S 1 600 Cash Payout Over Next 5 Years News Wwc

Search by Organisation Name Organisation ID.

. Online DSA Loan Agent Registration benefits DSA Loan agent registration online program available for Pan India locations opportunity to earn highest payout 100 digital process available wide range of financial products with loans and credit cards insurance products mutual funds and many more services available for sourcing for DSA loan agents at DOL Partner. Eligible households should have received three tranches of the quarterly. When Will I Get My GST Voucher U-Save Special Payment.

Mr Tan is under 55 years old. Some 950000 households in Housing Board flats will receive their quarterly Goods and Services Tax GST Voucher - U-Save rebates this month. Star Health and Allied Insurance and Niva Bupa Health Insurance having registration no.

This search allows you to check if an organisation is in the Auto-Inclusion Scheme AIS for Employment Income and the status of the file submission by the organisation for YA 2022. It is the sixth tranche of the payment in the current fiscal year meant to help lower- and middle-income families during the Covid-19 pandemic. CA0113 valid till 31-Mar-2022.

The GST rates for various products have been revised several times by the GST council since the inception of the Goods and Services Tax The latest rate revision was brought into effect in the 41 st GST Council Meeting which was held on Aug 27 2020. Affordable payment gateway charges with 100 payment modes. Large value depositors of the erstwhile Punjab and Maharashtra Co-operative Bank PMC can expect a faster payout according to the final notification of the banks restructuring plan by the government.

For 2021 households that receive the GST Voucher U-Save will also receive a GST Voucher U-Save Special Payment. The GST Voucher U-Save will be paid out in April 2021 July 2021 October 2021 and January 2022. For Year of Assessment 2022 Mr Tan may claim a total CPF Cash Top-up Relief of 12000 5000 7000.

This was paid out in April 2021 and July 2021. He makes cash top-ups of 5000 to his own CPF Special Account and 10000 to his mothers CPF Retirement Account in 2021 to enjoy tax relief for Year of Assessment 2022. All Systematic Equity Plan transactions would attract brokerage equivalent to Cash segment.

The Silver Support SS Scheme is part of a wider suite of schemes eg. The GST Voucher is given in three components - Cash Medisave and U-Save. Taking twice of the second cash payout would be equivalent to 1-month contracted gross rent as indicated in the stamped lease agreement for the period 22 Jul 2021 to 18 Aug 2021.

Healthcare subsidies GST voucher that the Government has put in place in recent years to give seniors greater assurance in retirement. The GST Council chaired by Finance Minister Nirmala Sitharaman will meet on December 31 and discuss among other things report of the panel of state ministers on rate rationalisation. Get premium online stores at just 8day with in-built payment gateway shipping and more.

Citizens may check their eligibility details and update their payment instruction at the GST Voucher website. According to the draft scheme the first pay-out for retail depositors above Rs 5 lakh will start from year one faster than the second year pay out as per the draft. It provides a quarterly cash supplement to seniors who had low incomes during their working years and now have less in retirement.

In terms of dividend the stock pays a very respectable 292 dividend yield which works out to be a 010 monthly dividend. Enjoy unlimited cash rewards and earn payback points with our Coral credit card. GST Securities Transaction Tax STT SEBI turnover charges.

The minimum brokerage for. Check online store pricing and payment gateway pricing for your eCommerce business. Before that there have been many GST Council Meetings in which certain rate revisions were introduced.

The third cash payout will be distributed automatically to all recipients of the second cash payout to ensure that eligible tenants and owner-occupiers receive their payout as quickly as possible. The permanent GST Voucher scheme was introduced by the Government in Budget 2012 to help lower-income Singaporeans.