fha loan colorado down payment

Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. The assistance funds come in the form of a zero-interest second mortgage with a 30-year term.

Fha Down Payment Assistance Programs For 2022 Fha Lenders

FHA Debt to Income Ratio.

. You wont be able to take advantage of the low-down-payment options these loan types offer. To afford a house that costs 300000 with a down payment of 60000 youd need to earn 44764 per year before tax. However an individual lender may also impose more strict credit score limits as long as.

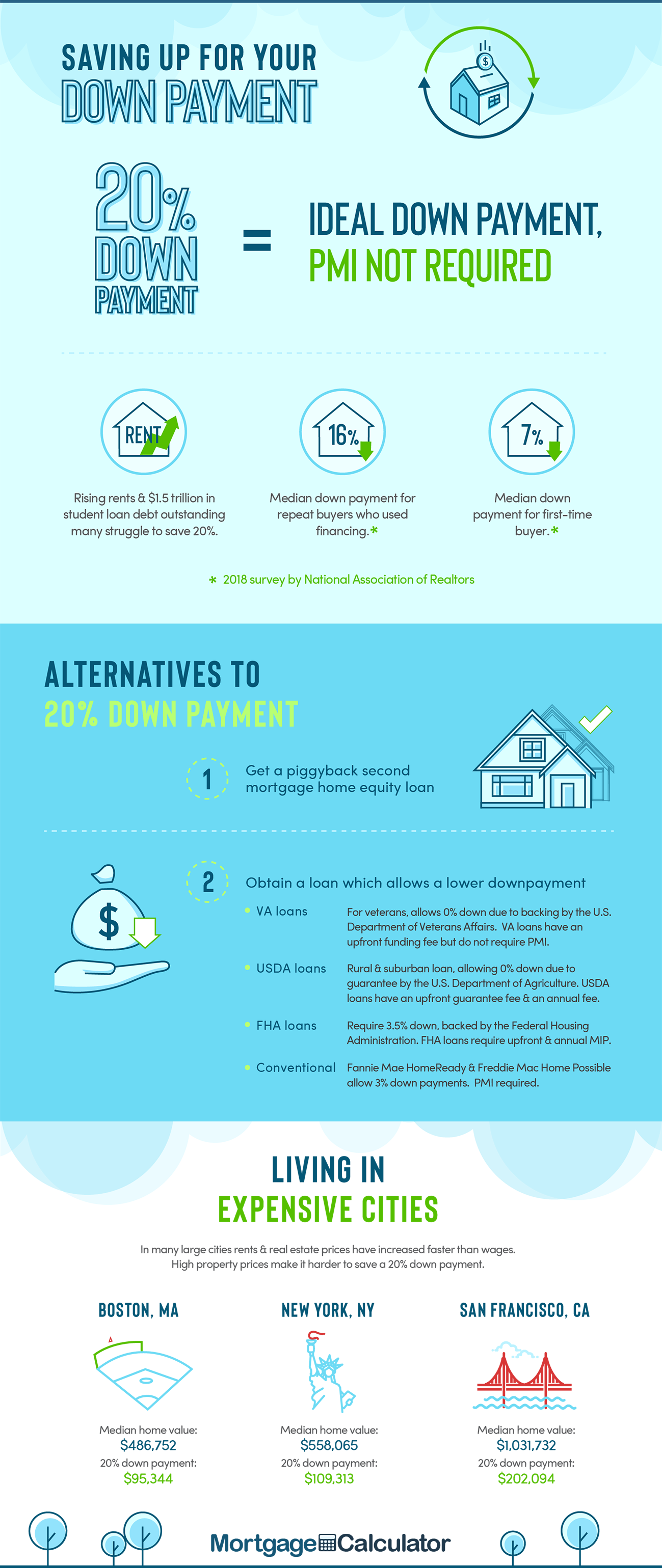

5 mortgages that require no down payment or a small down. This page updated and accurate as of June 14 2022 FHA Mortgage Source. This could limit your down payment options.

Updated for 2022 the complete mortgage loan limit guide for conforming FHA VA mortgages. This includes the current FHA guidelines related to income debt-to-income ratios and employment. This the minimum 35 downpayment required for FHA Loans.

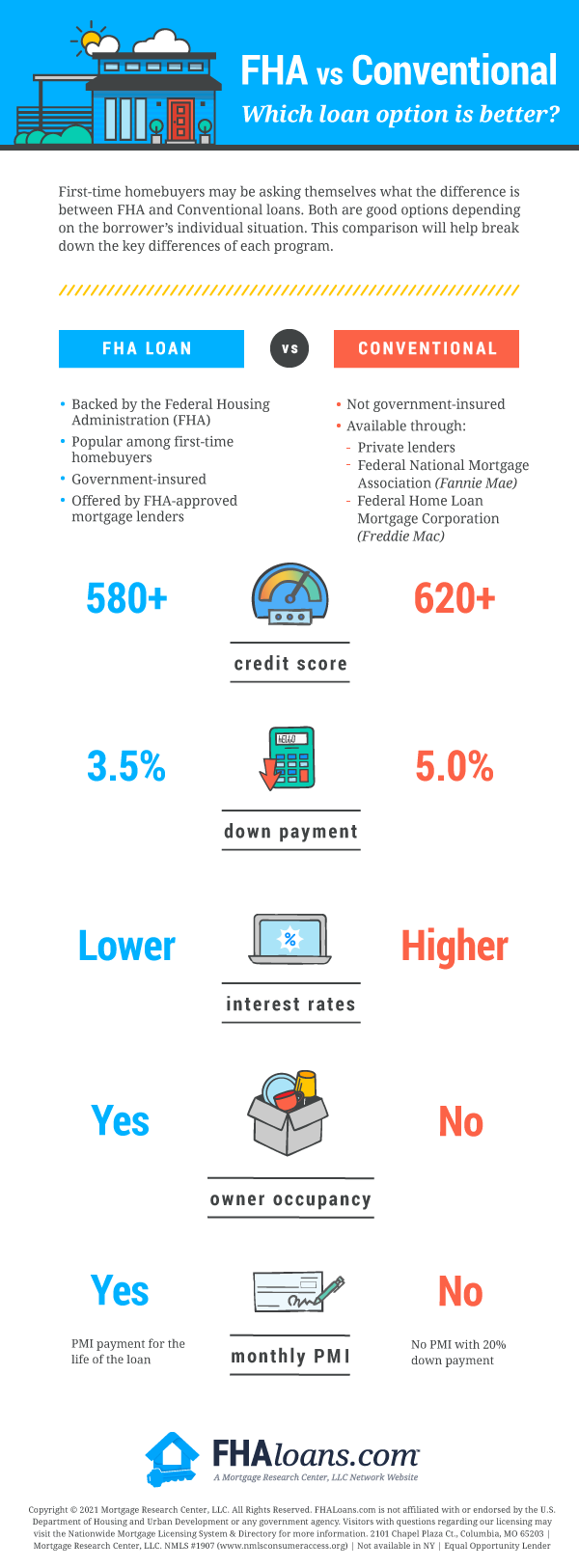

Meanwhile borrowers with credit scores between 500 and 579 can take this mortgage option with a 10 down payment. Low 35 Down Payment Requirements Credit Score Requirements as Low as 580. The Pros of a Larger Down Payment.

The pros and cons of paying off your mortgage early. Find and compare mortgage rates. That means you pay less in total interest costs over the life of the loan and you also benefit from lower monthly paymentsTo see how this works for yourself gather the numbers from any loan youre considering and plug.

FHA loans actually do not have a minimum income requirement nor are. View the current FHA and conforming loan limits for all counties in California. Youll pay an upfront mortgage premium UFMIP which normally amounts to 175 of your base loan amount.

VA loans dont require any down payments at all. Your downpayment of 20000 is 10 of the home value. FHA loan mortgage insurance is typically paid for the life of your loan unless you make a down payment of 10 or more in which case MIP comes off after 11 years.

FHA Loan Income Requirements Debt Guidelines You may be curious how much income is needed to qualify for an FHA loan. Borrowers with a troubled credit history may have difficulty getting approved by conventional lenders. This is the loan that comes with 35 down payment if a borrower has a credit score of 580.

Baseline FHA debt to income ratio limits are. DTI for 3 down payment FHA loans and FHA mortgage insurance may include a degree of flexibility if an Automated Underwriting System is used. FHA loans are the 1 loan type in America.

Each California county conforming loan limit is displayed. The more you pay upfront the smaller your loan. More Conventional Loan Requirements.

Conventional Loan Down Payment. With FHA backing you can often get approved with a low credit score and even a history of bankruptcy or foreclosure. The use you have planned for the property will impact how gift funds can be used.

Jumbo Loan Limits. In the US the Federal government created several programs or government sponsored. FHA Loan Guidelines Self Employed Buyers.

DOWN PAYMENT ASSISTANCE MAY BE. Depending on the loan type you can use gift funds to cover some or all of the down payment. Heres what you need to know.

A mortgage insurance premium MIP is a required payment for an FHA loan. Down payment options fewer in some parts of the. The FHA basic mortgage program is eligible for single family housing to multifamily housing.

A bigger down payment helps you minimize borrowing. Down payment gift rules by loan type. For FHA loans the minimum credit score for a loan with a 35 percent down payment with a credit score minimum of 600 from most lenders.

Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. Your home value of 325000 the FHA Loan Limit for a Single in Monroe. Funded by the CBC Mortgage Agency this program offers the ability to utilize an FHA-insured home loan by offering eligible applicants 35 of the purchase price to cover the down-payment.

FHA loans allow you to put down as little as 35 if you have a credit score of 580 or better or 10 if your credit score is. The monthly mortgage payment would be 1044. FHA loans for instance require down payments as low as 35 percent of a homes final purchase price.

If purchasing a primary residence the loan options above may all be on the table. Salary needed for 300000 dollar mortgage. This page covers the FHA loan income requirements for 2022.

Fha Credit Requirements For 2022 Fha Lenders

Fha Criteria For 2012 Borrowers Can Expect More Of The Same

Colorado Fha Lenders Colorado Fha Loans 2022 Fha Lenders

Fha Vs Conventional Loan Is There A Difference

Fha Loan Calculator Check Your Fha Mortgage Payment

Fha Loan Down Payment Requirements

Zero Down Fha Loan Qualify Now Fha Lenders

Fha Loan Requirements 2022 Rates Eligibility

Home Loan Downpayment Calculator

Fha Down Payment Assistance Programs For 2022 Fha Lenders

Fha Loan In Colorado Springs 719 Lending

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loans Everything You Need To Know

Oregon Fha Loan Requirements The 3 5 Down Payment

What Down Payment Is Needed For An Fha Loan Richmond American Homes

First Time Home Buyer Colorado Programs Down Payment Assistance 2021 Ashford Realty Group

Fha Loan Colorado 2022 Fha Loan Limits Co Mortgageblog

How To Qualify For A Kentucky Fha Home Loan Fha Mortgage Mortgage Loans Home Loans

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information